Welcome to Login

微信登录

打开手机微信,扫描二维码

扫描成功

请勿刷新本页面,按手机提示操作

中科曙光不会以任何理由要求您转账汇款,谨防诈骗

您的微信还未注册

中科曙光不会以任何理由要求您转账汇款,谨防诈骗

您可以同时关注中科曙光微信公众号

使用微信扫一扫即可登录! 查阅资料更方便、 快捷!

您已经注册账号和

关注微信公众号

2025年1月

服务热线:400-810-0466

Tax and Industry

With the comprehensive reform and upgrading of China's tax system, Shuguang cloud computing, big data, artificial intelligence and other technologies and tax systems are widely docked and deeply integrated, actively promoting tax digitalization and intelligent transformation and upgrading, and achieving smart tax business innovation and service innovation. Dawning participated in the construction of the core system of the Golden Tax Project and signed a total of several hundred million yuan.

Solution for tax-base network for the tax system

The horizontal network system of tax-base is the electronic tax paying system established by the people's bank of China, the ministry of finance, the state administration for taxation and commercial banks. The operation of the tax-base’s horizontal network system provides convenient and fast service for the tax payers.

With the increasing speed of the establishment of tax information, the tax authorities push forward the diversification of reporting patterns and comprehensive application of tax collection and administration system to realize the informationization management over the information of tax. In the meantime, the departments of the national treasury and banks which are related to the storage of taxes are also using the information processing of data. However, with no clear information network among tax authorities, national treasury and banks, they still use paper certifications to distribute information and record manually, resulting in the duplicated data collection of the three departments’ tax collection. It causes heavy load of work and low efficiency and the disadvantages of tax authorities’ real-time monitoring on the conditions of tax collection. It is already a crucial issue to realize the network processing of tax information for the tax departments.

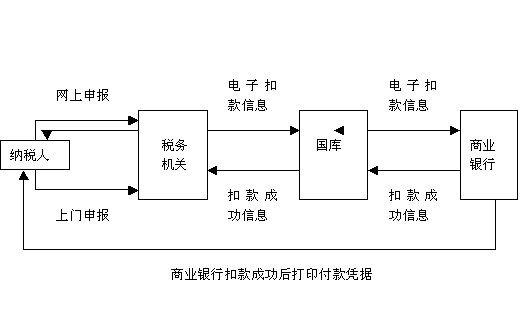

The network system of tax-base uses electronic settlement method, which is based on the multi-reporting system and computer network, to hand over the taxes into base automatically and distribute and process the tax’s pay into treasury information among tax authorities, National treasury and banks, realizing the electronic network tax-paying model with features of all-in-one tax’s paying and off-paying, entering the treasury and electrify of the account checking. The basic procedure is that the tax authorities use multiple reporting model to collect tax payers’ information and generate collection information and then deliver the collection information to the tax payer’s deposit bank through network. The tax payer’s deposit bank conduct the collection of taxes according to the collection information delivered by the tax authorities and return the taxing results to the tax authorities. The tax authorities will deliver the tax receipt information of the succeed taxing to the national treasury and automatically release it in the comprehensive paying and management software. In the meantime, the bank and national treasury conduct tax fund settlement, after which delivering the overall funding amount of settlement together with the detailed information of tax receipts to the national treasury through network. According to the distributed settlement information by banks and collection information from tax authorities, the national treasury conducts reconciliation for the base’s taxes. At the same time, it will also make relevant processing before put them into base and generate base information in its business operation and processing system. It will then deliver the base information and reconciliation information to national tax department, who will conduct automatically release and reconcile it. After these, all tax basing works are all done.

1.1.1 Advantages of solution

The success functioning of the tax-base network for the tax system brings the following changes.

Firstly it brings convenience for the tax payment of the tax payers and improves the taxing service’s quality. The first one is the tax declaration link, which changes from the original declaration at the tax hall to the network declaration. The tax payment link has realized multiple payment types, including real-time deductions, batch declare payment of tax and bank side declaration of payment, and supports 7 days and 24 hours continuous functioning. The combination with electronic declaration helps the realization of indoor tax payment for tax payers, which reduces the costs of tax payment.

Secondly it benefits the in-time and full amount of tax payment’s storage, improving the collection and management qualities of taxes. Before the connection, one tax will normally need three or five days before it is delivered to the national treasury from the declaration of the tax payment, sometime it will need more than 10 days or even half a month for some countries and remote areas. After the connection, one tax will only need half a day before it is delivered to the National Treasury from the declaration of the tax payment. With the gradual optimization of the system, it can finally realize the real-time tax storage of the tax payment, which could efficiently reduce the distribution time of financial capital. In the meantime, the tax authorities can have real-time control over the tax declaration and payment conditions through the network system, conducting followed up works of tax hastening and tax inspecting.

The third is that it increases the working efficiency of tax authorities, national treasury and banks and lowers the tax costs. It realizes the electronic declaration of tax payment after connected to the network, which basically cancels the paper tax receipt. The tax staffs do not need to conduct manually recording of the tax payment information and the professionals of the National Treasury do not need to conduct manually recording of thepaper tax receipt. The system realizes automatic checks of the accounts. The electronic tax receipt replace paper tax receipt, which improve the working efficiency and lower the taxing costs.

The fourth is that it improves the utilization efficiency of tax information. Before connected to the network, the tax receipt only records limited information and the fiscal, taxation and the National Treasury only conduct one time of reconciliation once a month which leads to the lower utilization of information. After connected to the network, the fiscal, taxation and the National Treasury realize the real-time distribution of information and conduct reconciliation of debt once a day, improving the utilization of network information.

1.1.2 System structure

Dawning Information Industry Co.,Ltd. Sugon Building, No.36 Zhongguancun Software Park, No.8 Dongbeiwang West Road, Haidian District, Beijing 100193

Tel:+86 400-810-0466

Fax:+86 10-56308222

E-mail:international@sugon.com

Dawning Information Industry Co.,Ltd. Sugon Building, No.36 Zhongguancun Software Park, No.8 Dongbeiwang West Road, Haidian District, Beijing 100193

Tel:+86 400-810-0466

Fax:+86 10-56308222

E-mail:international@sugon.com

Register /

Register /